capital gains tax increase date

Not only would President Bidens plan increase the capital gains tax. Note that short-term capital gains taxes are even higher.

Estimated Income Tax Spreadsheet Mike Sandrik

The proposal would increase the maximum stated capital gain rate from 20 to 25.

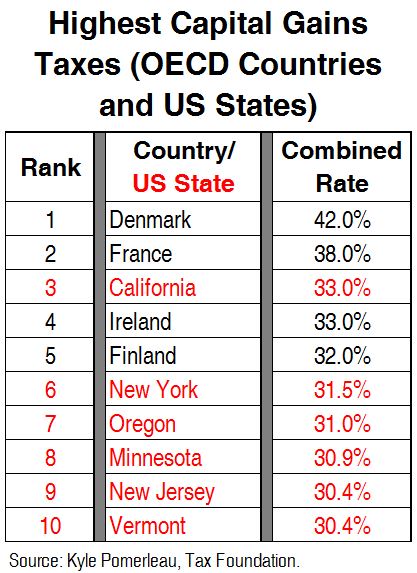

. Combined with a 38 Medicare surtax the richest Americans would pay a 434 top rate on capital gains. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long.

Currently there are seven different tax rates for individuals the lowest being 10 and the highest falling from 396 to 37. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Currently the capital gains rate is 20 for.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. The capital gains tax on most net gains is no more than 15 for most people. From 1954 to 1967 the maximum capital gains tax rate was 25.

Published 10 days ago. Increasing the federal capital gains rate to 434 for taxpayers with adjusted gross income over 1 million. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. In 1978 Congress eliminated. This resulted in a 60.

While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. It would apply to taxpayers with income of more than 1 million.

These gains are taxed as per the ordinary income tax rate 10 12 22 24 32 35 or 37. The effective date for this increase would be September 13 2021. Long-Term Capital Gains Taxes.

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. Additionally there are four tax rates for estates and.

Assume the Federal capital gains tax rate in 2026 becomes 28. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. In the case of long-term capital gains you are taxed at rates of 0 15 or.

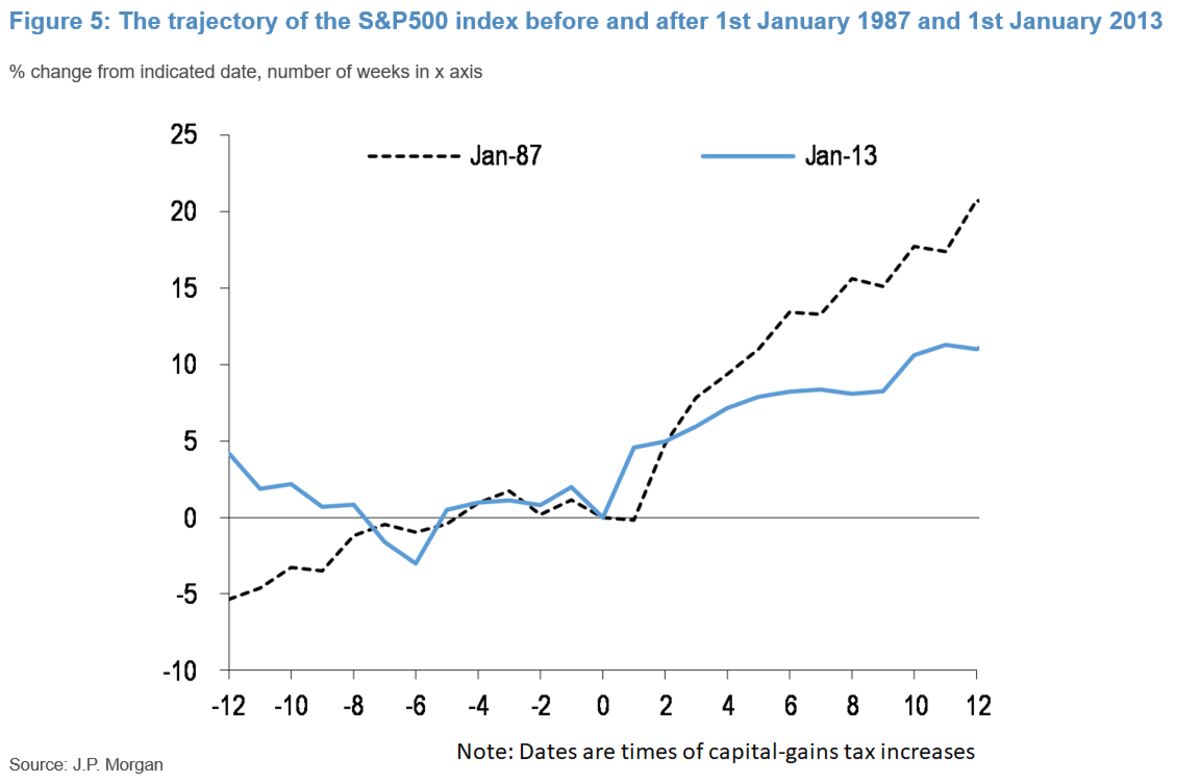

Jpmorgan Says U S Capital Gains Tax Hike May Briefly Hit Stocks Bnn Bloomberg

What Happened Quietly On January 1 2015 Snopes Com

Report Highlights Need For Additional Revenue Options Center For Effective Government

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax Archives Skloff Financial Group

Capital Gains Tax Archives Skloff Financial Group

Espp Gain And Tax Calculator Equity Ftw

Calculate Your Capital Gains Tax In 5 Easy Steps

Restricted Stock Units Rsus Facts

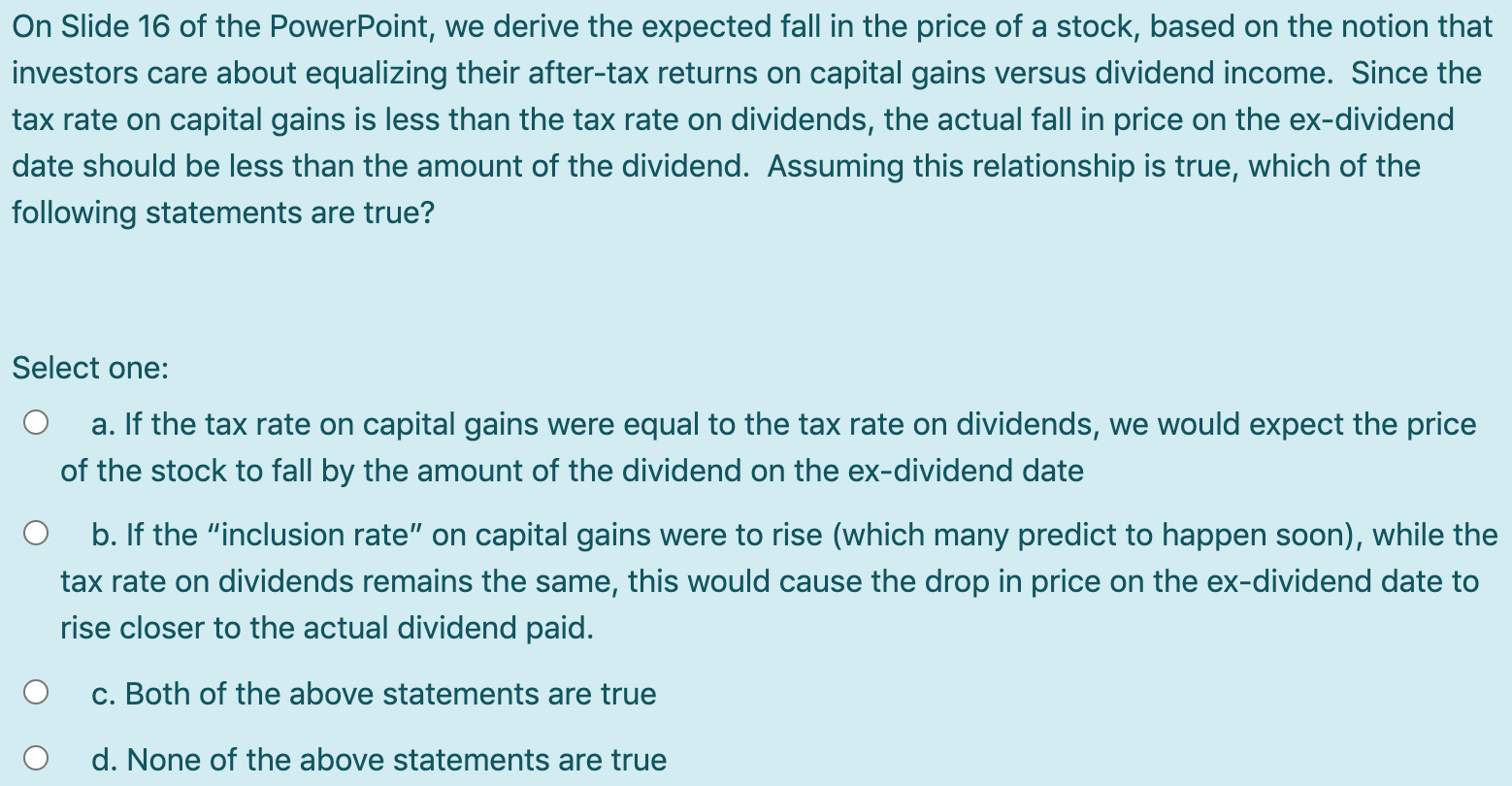

Solved On Slide 16 Of The Powerpoint We Derive The Expected Chegg Com

What You Need To Know About Capital Gains Tax

How To Avoid Capital Gains Tax When Selling Your Home

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

Income Tax Law Changes What Advisors Need To Know

Free Pdf Guide To Completing A Capital Gains Tax Return Cg1 For Stocks Crypto Ireland Youtube

Capital Gains Tax In The United States Wikipedia

Capital Gains Deduction Is An Expensive Loophole Benefiting A Small Number Of Oklahomans Guest Post Cynthia Rogers Ph D Oklahoma Policy Institute

If Democrats Win In November Brief Hit To Stocks Equities Jpmorgan Says Bloomberg